This January we’re going to look into the various ‘grudge purchases’ around different insurance products, such as car, home, health and even life to see how you might save time, money and worry in choosing what suits.

There are few certainties in life but it’s a fair bet that come April 1 your private health insurance premium will rise by far more than your income or ...

read more>

News

The New Year always dawns with the news of government services thoughtfully jacking up fees and charges and altering the rules when we are least aware.

Post and pharmaceuticals costs have already changed and big ‘reforms’ are afoot for health insurance. Some pension rules have been tweaked, but the major eligibility changes are now just 12 months away.

Given forewarned is fore...

read more>

We bounce many figures and statistics at you in the FiftyUp Club: discounts (nice) or surcharges (nasty) and even pension taper rates (complex).

But the most important number relates to the spectacular growth of 32% we have enjoyed in 2015, meaning there are now almost 150,000 members!

It’s not just thanks to our media partners for getting the word out to you about the ben...

read more>

When it comes to health and good cheer the glass can be half full too when it comes to health ageing

Given this is the season of good cheer and no one needs any more lectures about what we are doing wrong, how about some new research on what some are doing right?

There are few more important, or irritating, guidelines about how much, or little, we should eat and drink and exercise to enjoy more healthy ageing.

Often the news reports focus on who is doing what and with good reason bec...

read more>

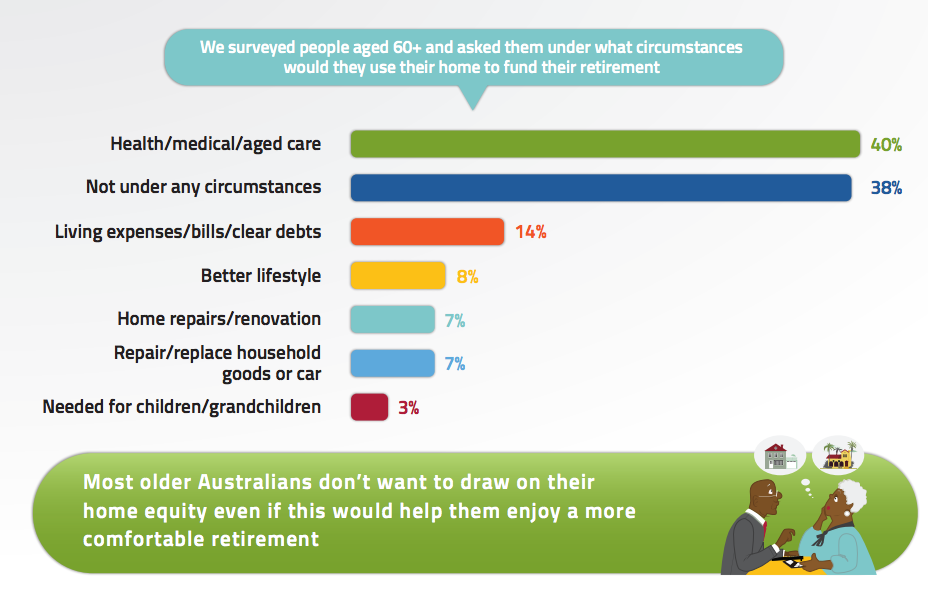

It is a paradox which has the policy makers in a spin. Most older Australians have no intention in dipping into the equity in their own home even if it leads to a more comfortable retirement.

Almost ¾ of those aged 65 and over own their residence without a mortgage and, despite being asset rich and income poor, are largely uninterested in using their ‘castle’ to fund their...

read more>