Some home truths about the housing decisions older Australians can make

It is a paradox which has the policy makers in a spin. Most older Australians have no intention in dipping into the equity in their own home even if it leads to a more comfortable retirement.

Almost ¾ of those aged 65 and over own their residence without a mortgage and, despite being asset rich and income poor, are largely uninterested in using their ‘castle’ to fund their retirement costs.

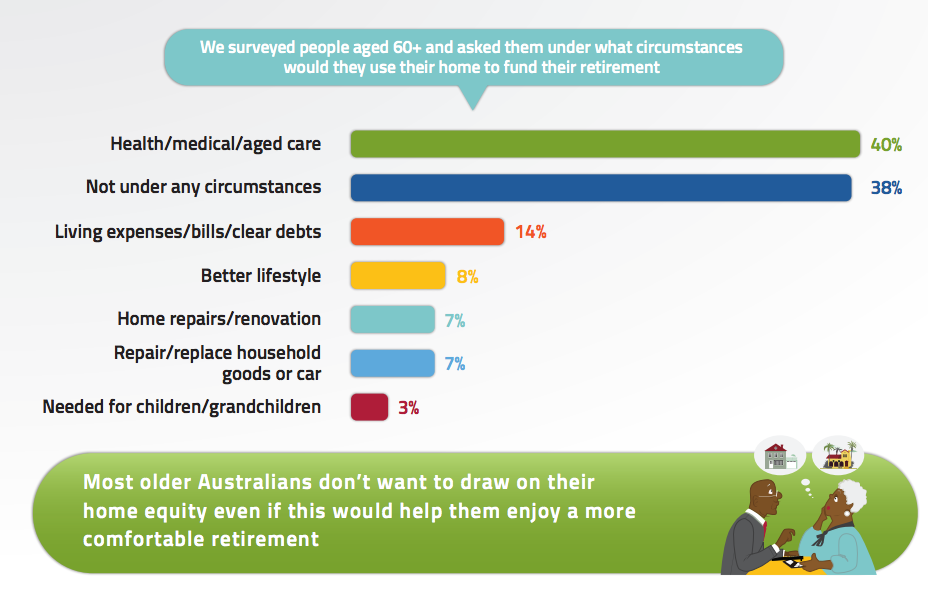

When asked if they would dip into what for many has been a massively appreciating asset 38% said ‘not under any circumstances’ and 40% only for health/medical and aged care.

Some of the headlines around the research, done by the government’s Productivity Commission into the Housing Decisions of Older Australians, has focused on issues such the family home in the pension assets test.

And while both sides of politics say they have no intention to make such a move there’s no doubt various think tanks believe it is time for a change-- especially with an election year looming.

In the meantime it’s well worth considering the Productivity Commission’s findings to arm yourself with some information to make better decisions for yourself and hopefully stop politicians making idiotic ones on our behalf.

The report states the obvious that housing has the dual role as a place to live, with 83% expressing a strong preference to stay put, and as source of wealth now valued collectively at $1 trillion.

It says there’s an aligned interest between such older Australian and the government. It’s much cheaper for the government to provide in home care ( 800,000 now get it) than fund residential age care which is fast becoming an end of life care service ie only for 2-3 years stay.

Only one per cent have a preference to live in a aged care facility, two per cent in a mobile home park and just six per cent in a retirement village.

Staying in the family home is certainly the overwhelming choice but it comes at a cost.

The irony, as the Productivity Commission sees it, is that many older and particularly less wealthy Australians continue saving even though they face higher health and aged care costs.

They are more likely to cut their spending than draw down on their wealth, such as the family home, which the commission sees as a untapped source of retirement income.

The explanation given in the report is a strong aversion to any debt in old age and what’s called ‘precautionary saving’ driven by uncertainty around the costs of living longer and health and care needs.

There are financial equity release products, such as reverse mortgages, on the market but the report says the market is small and despite the potential is unlikely to grow in the short term.

While the number of renters in older age is between 15-20% they are says the report a significant and vulnerable minority more likely to experience housing stress and insecure tenure and inadequate government support.

We are going to hear a lot more about the housing decisions of older Australians how some 15% of pensioners, if they sold their homes, would have no need of the pension.

Such a move might save the government $6 billion a year but what might it cost the pensioner?