Big Insurers Put On Notice

Research this week by Professor Allan Fels found some households could be paying as much as $1700 more than an identical home next door for Home & Contents Insurance!

The findings have reignited calls for an independent comparison website for home and car insurance, and the industry is pushing back as always.

Last November Senator Nick Xenophon put a motion to the Upper House for an Economic References Committee inquiry into whether there is a need for an independent comparison service, like we have in the private health sector. Savvy shoppers can go to privatehealth.gov.au and compare policies relatively easily.

But Insurance Council of Australia chief executive Rob Whelan branded the comparisons "misleading" and said comparison websites "do not best serve the interests of consumers.”

Key points:

- The suburb of Medlow Bath in the Blue Mountains has up to $1,700 difference

- A typical average quote for Randwick might be $1,674 but identical properties in the same suburb are $1,062, that's over $600 cheaper.

- In the inner Western Sydney suburb of Concord, the differences are around $800 to $900 between the most expensive and the cheapest premium

Which brings us to the Emergency Services Levy.

The Levy funds important emergency services like Fire and Rescue NSW, Rural Fire Services and NSW State Emergency Services. From 1 July 2017 the Levy, which is currently collected by Insurers on behalf of the Government will instead be replaced by the Emergency Services Property Levy (ESPL), which will be paid alongside local council rates. What this means in theory is that your council rates will probably go up and your home insurance premiums should (and I use the word loosely) come down.

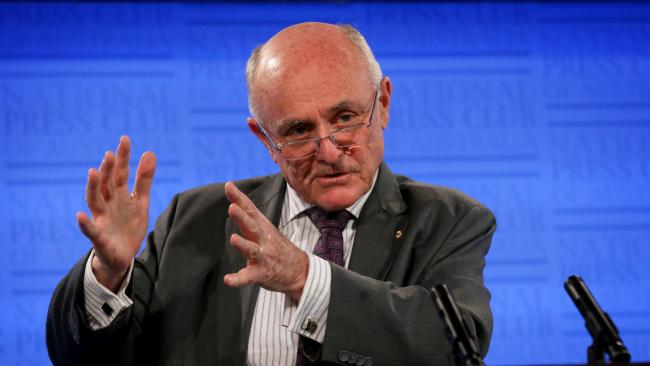

Allan Fels, best known for his role as chairman of the Australian Competition and Consumer Commission, now heads up the Emergency Services Levy Insurance Monitor, which basically will make sure insurance companies pass on the savings to policy holders...

This much-welcomed change brings NSW into line with other states that already do this but don’t expect the insurance companies to be happy about it.

Public Defender, John Rolfe from the Daily Telegraph has also made a submission to the Economic References Committee Inquiry suggesting we need a transparent comparison tool for home and car insurance that not only compares insurers on price but on value for money.

What most people probably don’t know (I didn’t) is that there are really only 2, yes 2, major players in the market. IAG and Suncorp sit behind most brands of home and car insurance product in the country.

These insurers probably don’t want you to know that your neighbour could be getting a much better deal for a similar product than you are.

They will tell you there are too many variables to be able to compare... things like whether you go for Agreed Value or Total Replacement. They have even tried linking climate change to an increase in claims.

They argue that having an independent comparison tool would put smaller operators out of the market. Try telling that to iiNet, TPG and any other number of small telco providers who are thriving in their space.

Federal Minister for Finance Kelly O’Dwyer will make the final decision on any comparison website, let’s hope she takes into consideration the thousands of names on John Rolfe’s petition. Click here to add your name to the petition:

https://www.change.org/p/kelly-o-dwyer-protect-aussies-against-ludicrous-insurance-fees-with-price-comparison-site

Click here to hear John Rolfe’s interview on the Daily Drive

http://www.smh.com.au/business/consumer-affairs/call-for-transparency-over-variations-in-home-insurance-premiums-20170320-gv1v3m.html