Why cost of living pressures hit older Aussies hardest

Although the less well-off tend to suffer more from cost of living pressures, it doesn’t stop the better-off from complaining too.

The dazzling high-tech signage of $2-a-litre petrol can raise a certain anxiety regardless of whether you drive a shiny new Porsche or a dusty old Falcon.

But it seems that retirees and older Australians might be particularly susceptible to consumer price inflation. And if so, what do you do to keep ahead of upwardly mobile prices?

The mounting cost of living is already shaping up as a critical battleground in the coming election despite the fact there’s not much either side can do about it.

The prices of food, fuel and housing, which have all shot up, are set by many factors, and despite much huffing and puffing, the government can be sorely limited in its options.

Apart from increasing compensation for the least well off, the best the authorities can do is ensure that markets operate fairly and openly.

It’s to ensure price transparency when prices swing so dynamically that petrol stations must vividly display the cost of their fuels.

So why are retirees so hard hit? According to the Association of Superannuation Funds of Australia (ASFA), single retirees who own their homes face a 3.9% hike in the price of goods and services.

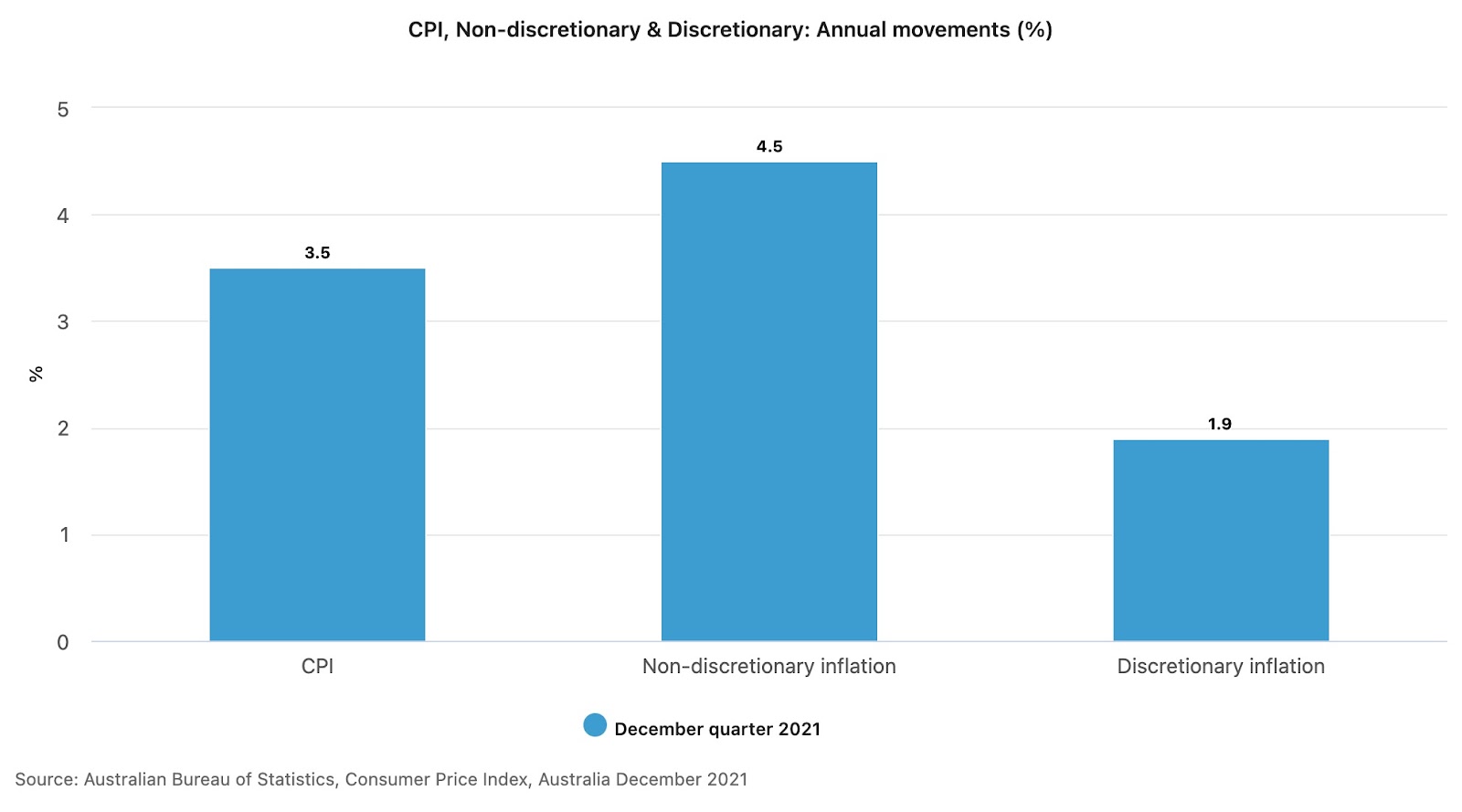

For a couple, it was 3.5%, the highest annual increase for 11 years. Compare this with the Sydney Consumer Price Index (CPI) for all groups, which is 3.1%.

The difference lies in what’s called the non-discretionary items that retirees have to buy, and you can’t always make much saving by switching, such as food and petrol. Also, health costs which weigh more heavily on older groups went up by 3.3%.

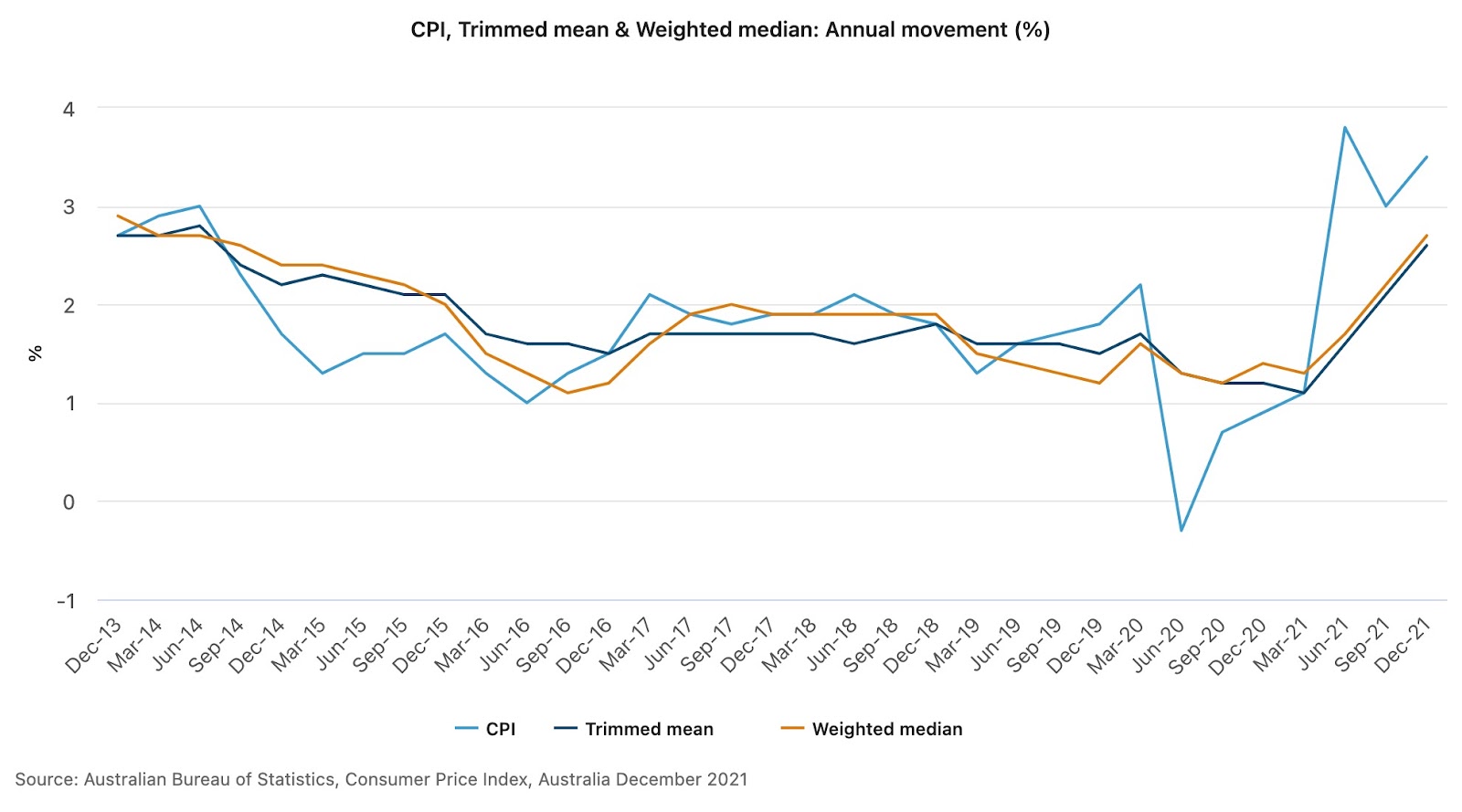

“Non-discretionary annual inflation is higher than the CPI and more than twice the rate of Discretionary inflation. Non-discretionary inflation includes goods and services that households are less likely to reduce their consumption of, such as food, automotive fuel, housing and health costs, “ says the ABS.

We are generally sensitive that the prices for petrol, meat, car repairs, home maintenance have gone up but often less aware the cost of electricity, fruit and garments have dropped.

And we don’t always factor in how certain costs, such as health, will increase as we get older.

As ASFA warns, “Retiree households will face ever-increasing health costs. While there is considerable subsidisation of health costs, out of pocket expenses remain substantial for items such as dental treatment, gap payments for procedures in hospitals and emerging items such as the cost of COVID-19 rapid antigen tests.”

So there’s the good news, but what are you doing about it? Any good tips about avoiding the price increases or at least accommodating them without too much pain?

Also, how about in a year or ten years, apart from how well you manage today?

Any information contained in this communication is general advice, it does not take into account your individual circumstances, objectives, financial situation or needs.