Would you fall for these scams?

One of the cruel ironies of financial scams is that we like to think only suckers get stung, and we'd never fall for the trickery, especially with a few extra years of experience.

Sadly, think again - there's research from the US which suggests over 65s, even with no cognitive decline, can suffer from what's called age-related financial vulnerability.

"We are learning that there are changes in the aging brain, even in the absence of diseases like Alzheimer's disease or other neurodegenerative illnesses, that may render older adults vulnerable to financial exploitation," said Dr Mark Lachs from Weill-Cornell Medicine in New York.

Older people are less likely to report scams, but when they do, their losses are significantly higher than younger cohorts. Elders tend to have accumulated and, dare one even think it, greedy relatives amongst the predatory strangers.

What's the most outrageous scam anyone has tried to pull on you, and (hopefully) how did you ignore it, avoid the temptation, and if you got stung, what did you do?

In Australia, the Australian Competition and Consumer Commission (ACCC) heard from 17,000 seniors who had been ripped off by a devious variety of cons in 2021. They put the money lost at $11 million, which would surely be an underestimate.

Forewarned is forearmed, so check out this list from the ACCC of the most common scams targeting older people.

Dating and romance scams

The bottom feeders abuse dating websites, apps or social media to present themselves as prospective companions. They know all the tricks to get you to hand over cash, goods or personal details.

Investment scams

As the ACCC warns, "Investment scams involve promises of big payouts, quick money or guaranteed returns. Always be suspicious of any investment opportunities that promise a high return with little or no risk – if it seems too good to be true, it probably is – and is highly likely to be a scam."

Unexpected prize and lottery scams

But first, you have to pay a fee to claim the prize even if you never entered to the gamble in the first place!

Inheritance scams

The attractive offer of free money from a dead and unknown benefactor is beguiling if just a little unlikely, but you can be tricked into handing over money first or credit card details.

And the list sadly goes on…

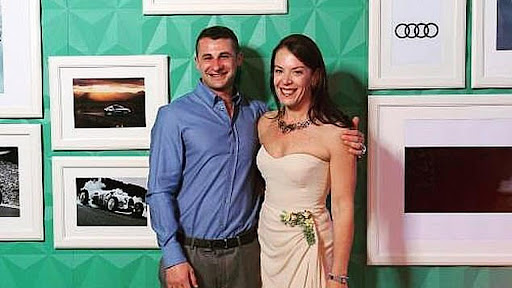

I recently met a couple in their fifties who had the misfortune to be old friends of the disgraced and presumed dead Ponzi-scheme queen and unlicenced final adviser Melissa Caddick.

She naturally took them for most of their life savings. If there was one, their failing was to trust Caddick and take years of the family friendship as some sort of safeguard.

Do you have any cautionary tales to share and help others avoid a painful and costly lesson?