What’s your best piece of advice for someone starting out (whether they want to hear it or not)?

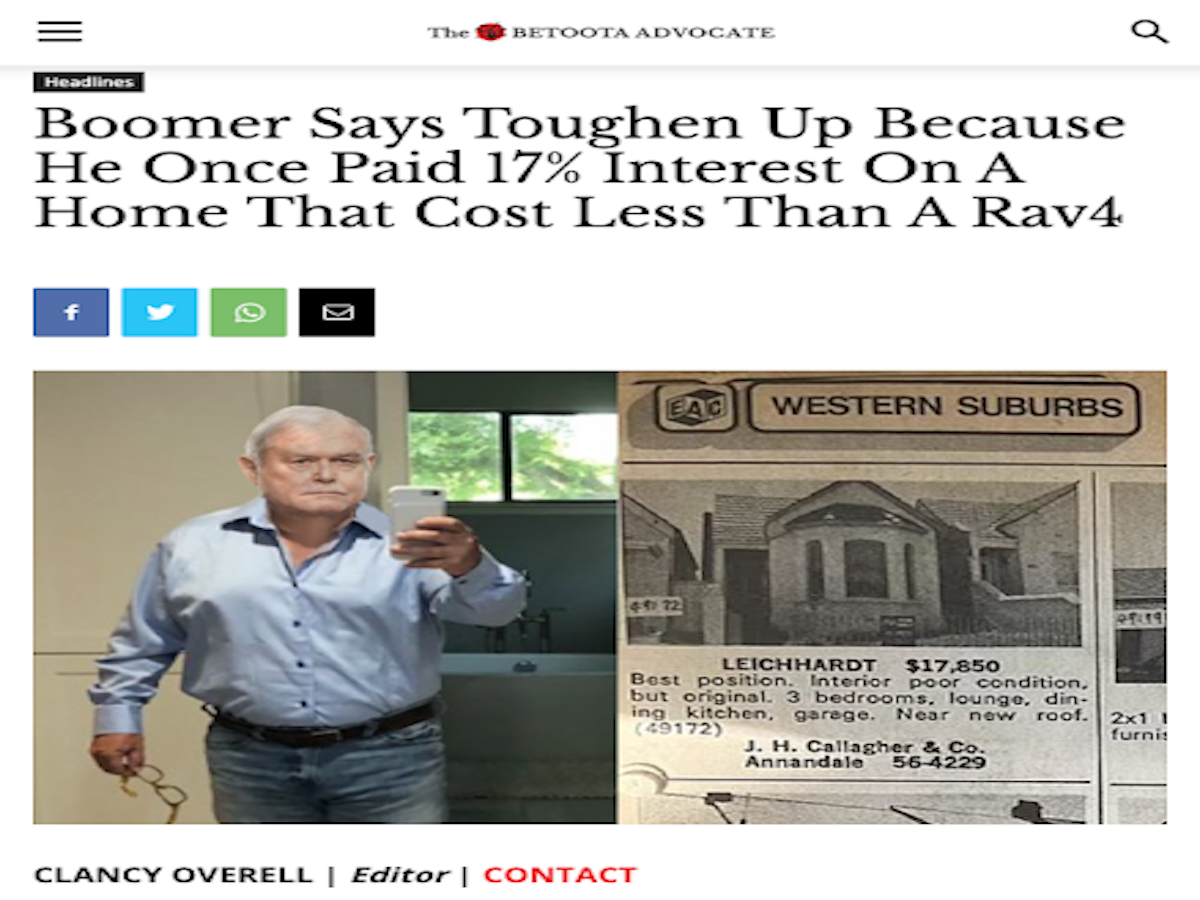

This was a recent headline in Australia’s most popular satirical newspaper.

When it appears you bought your house for peanuts, how to best advise younger people about coping with the rash of higher prices, and not sound patronising?

It's a dilemma highlighted with a cash rate increase for the first time in eleven years and many feeling the pinch and growing uncertainty of their world.

It may come as a bit of a shock to younger generations, but for those aged 50 and higher, in various ways, we have seen it all before.

Home loan rates are still meagre compared to the 17% plus some paid in the 1990s, but house prices now appear even more impossibly low today.

Maybe it's all swings and roundabouts, but what would you prefer with homeownership: a low entry purchase price and higher ongoing mortgage payments or the other way around?

Life is sadly never simple, and you can get stung at both ends, so knowing what you know now, what's the best advice you can hand down without being condescending?

In Scandinavia, they say, "There's no such thing as bad weather, only bad clothes." In other words, if you are prepared and protected, you can cope with most outcomes.

It may apply to money as well as meteorology, but for arguably one small problem. While the climate is changing, the world of money has shifted too, and what was true once may no longer hold fast.

For example, credit is far more available and inflation, until recently at least, has been tamed and also interest rates have hardly been lower.

Tie in social changes such as social mobility, marrying and family forming later, and living much longer, and old fashioned ideas such as 'Take care of the pennies and the pounds may take care of themselves' may no longer apply.

Many of these ideas are dealt with more deeply in a colleague's new book aimed at younger people called Live the Life You Want With The Money You Have by financial adviser Vince Scully.

So while we might be tempted to say eat out less and save more to youngsters struggling to raise a home deposit, the truth might be more complex.

What advice, patronising or otherwise, would you give to younger generations about making the most of the world in which they now live?

Any information contained in this communication is general advice, it does not take into account your individual circumstances, objectives, financial situation or needs.