Yet again retirement incomes policy has dominated the Budget with what’s been billed the largest change to superannuation for 10 years.

But beware of feeling too safe when you read about the hits only affecting the very wealthy and their $1 million plus retirement balances.

Those of more modest means who seek to top up their super may be in for shock when they begin to underst...

read more>

News

Our world is going to become increasingly dominated, thanks to the impending federal Budget and election, by matters of retirement incomes and investments and how they affect older Australians.

The sums involved, both in spending and saving, and the demographic bubble which is the baby boomer generation (1945-1964) means change is inevitable and will produce winners and losers.

The Budget...

read more>

Our world is going to become increasingly dominated, thanks to the impending federal Budget and election, by matters of retirement incomes and investments and how they affect older Australians.

The sums involved, both in spending and saving, and the demographic bubble which is the baby boomer generation (1945-1964) means change is inevitable and will produce winners and losers.

The Budget...

read more>

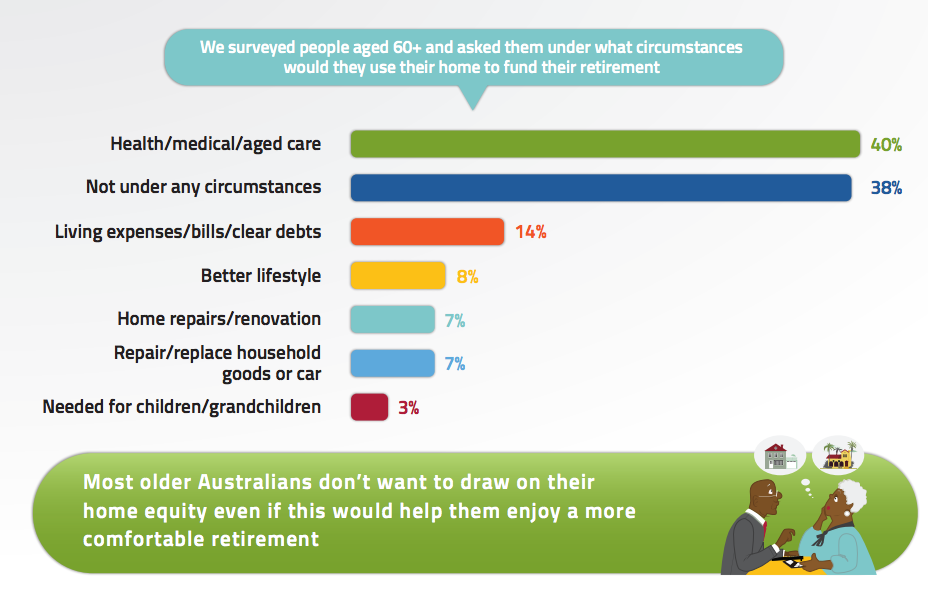

It is a paradox which has the policy makers in a spin. Most older Australians have no intention in dipping into the equity in their own home even if it leads to a more comfortable retirement.

Almost ¾ of those aged 65 and over own their residence without a mortgage and, despite being asset rich and income poor, are largely uninterested in using their ‘castle’ to fund their...

read more>

With so many days and even weeks assigned to marking worthy causes it’s fair enough to ask why do we need a loyalty tax day?

For one there’s more than 11 billion reasons representing the bucks we could all save if we compared the providers of essential services and moved to better deals.

Then there’s yet another price of old age creeping on. For each decade older we beco...

read more>